The SASB gas field is producing critical domestic supply of natural gas during the energy crisis gripping Europe at this time. SASB is a conventional gas field located in the Southwestern Black Sea, consisting of numerous conventional natural gas pools located in shallow water. The fields have produced over 43+ BCF since initial development in 2007. Production platforms, pipelines, initial wells and gas plant cost in excess of US$600m (100% interest). Trillion is redeveloping the field with a planned 17+/- well program commenced in 2022. Phase B outlines the target is to exit 2024 with 6 producing wells - 5 development wells and one stratigraphic well.

License block size: 12,387 Hectares. Expiration: licensed to 2032; renewable until 2042.

Royalty: 12.5%. Corporate tax rate: 22.5%. 2022 Projected CAPEX: USD$50m (2023)

- South Akcakoca Sub-Basin, Western Black Sea

- Block boundaries

- 2d seismic

- 3d seismic

- Existing SASB gas field offshore platforms

Additional Exploration Targets

Targets proximate to the platforms & pipelines Includes Stratigraphic Targets

Explore off-block for large natural gas structures

3,100 km of 2D seismic data delineating targets off block for future exploration

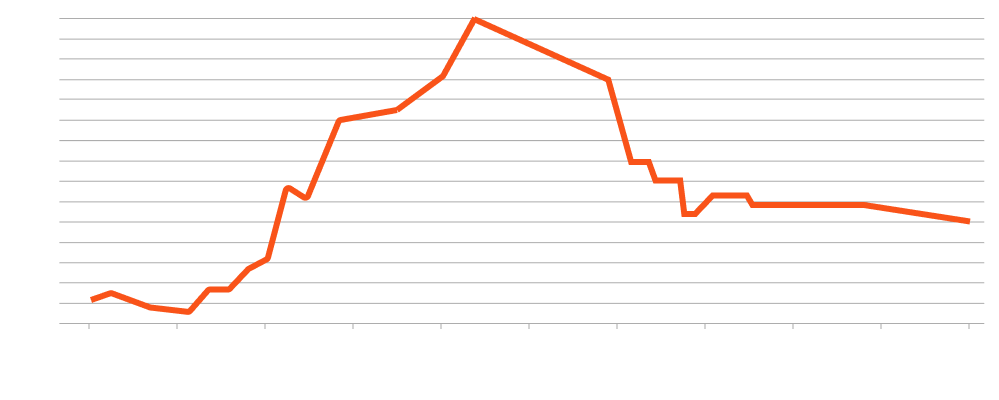

SALE PRICE (OCT 2024)

forecasted for end of 2024

- SASB Development Costs

- $42m+ equity financing (2022)

- High Regional Natural Gas prices USD $10/MCF

- Drilling Commenced in Sept 2022 - 6 wells completed to date

- Take or pay contract for all gas

- Cashflows reinvested into Programs B, C & D

- Drill 5 Wells

- Recomplete 1 Existing Well

- Focus on reserves

- Workover existing wells

- Velocity string installation to eliminate water loading

- Pump implementation

- Subsea Tie-In

- Drill 2+ sidetracks in 2025

- Drill 6+/- Wells in total

- Drill 5 Development Wells

- Drill 1 Stratagraphic Well

- Exploration - Stratagraphic Prospects and Channel Sands

- Exploration about the field is expected to yield new discoveries

- Off-block exploration

- Deep-water $30m + per well (100% interest)

- Shallow water

- Tie-ins for production extra

Reserve Report Highlights

- Net present value 10% (NPV10%) of total proved plus probable natural gas and oil reserves is USD $420.5 million* net to Trillion, which represents USD $3.44 per common share***

- Total proved plus probable conventional natural gas reserves increased to 55.75 Bcf* up from 42.5 Bcf* (2022), an increase of 31% from 2022.

- NPV10% of total proved reserves increased to US $134.3* million from US$ 123.8* million (2022), an increase of 8% from 2022.

- NPV10% of total proved plus probable plus possible reserves is USD $712.7 million net to Trillion.

- Total proved plus probable oil reserves of 240 Mbbl of oil for Cendere oil field compared to 252 Mbbl of oil in 2022.

*Trillion’s 49% interest before income tax and royalty **basic common shares

Reserve Report Summary

Gross Reserves*

*Trillion’s 49% interest before income tax and royalty

Net Present Value of Trillion Interest, before income taxes and after royalties*

*Trillion’s 49% interest before income tax and royalty

About the Reserves Evaluation

For the year ended December 31, 2023, the Company's reserves were evaluated by GLJ Ltd. ("GLJ"), in accordance with the definitions, standards and procedures contained in the Canadian Oil and Gas Evaluation Handbook maintained by the Society of Petroleum Evaluation Engineers (Calgary Chapter) ("COGEH") and National Instrument 51-101 - Standards of Disclosure for Oil and Gas Activities ("NI 51-101") and are based on the Company's 2023 year-end estimated reserves as evaluated by GLJ in their report dated April 11, 2024, with an effective date of December 31, 2023 (the "Reserves Report"). GLJ is an independent qualified reserves evaluator as defined in NI 51-101. Additional reserves information as required under NI 51-101 will be included in the Company's statement of reserves data and other oil and gas information on Form 51-101F1, which is expected to be filed on SEDAR+ by April 29, 2024. See "Advisory Note Regarding Oil and Gas Information" section in the "Advisories", at the end of this news release.